Hello again everyone! Welcome to Part II in the blog series, “My Favorite PeopleSoft Lease Administration Transactions.” In Part I, we looked at amending a multi-asset lease to remove an asset. In this installment, we will look at a lease with quarterly payments. We will also review how Lease Administration creates straight-line accounting entries. Additionally, my analysis will cover all the journal entries for this lease over its entire life span. This is essentially an end-to-end look at this lease. Without any further introductions, let’s jump right in!

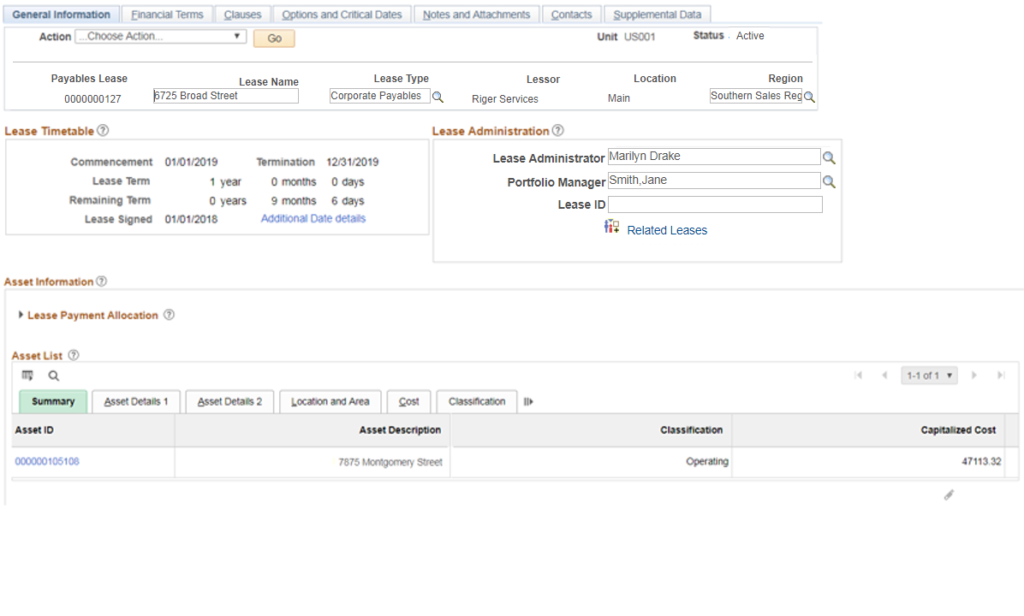

For this example, the lease data included:

- Lease Term – 01/01/2019 – 12/31/2019

- Payments – $12,000 per quarter on Jan 1st, Apr 1st, Jul 1st and Oct 1st

- No escalations

- Borrowing rate – 3%

- PVLP and ROU Capitalized Cost $47,113.32

In order to best illustrate the accounting entries for this lease, I set up the lease length for just one year. We will look at the accounting for the entire year. Though this lease is only for one year, the straight-line principles for this lease will apply to any lease with a similar payment stream regardless of length. Since the lease payments are quarterly, the timing for the straight-line accounting entries will repeat every quarter.

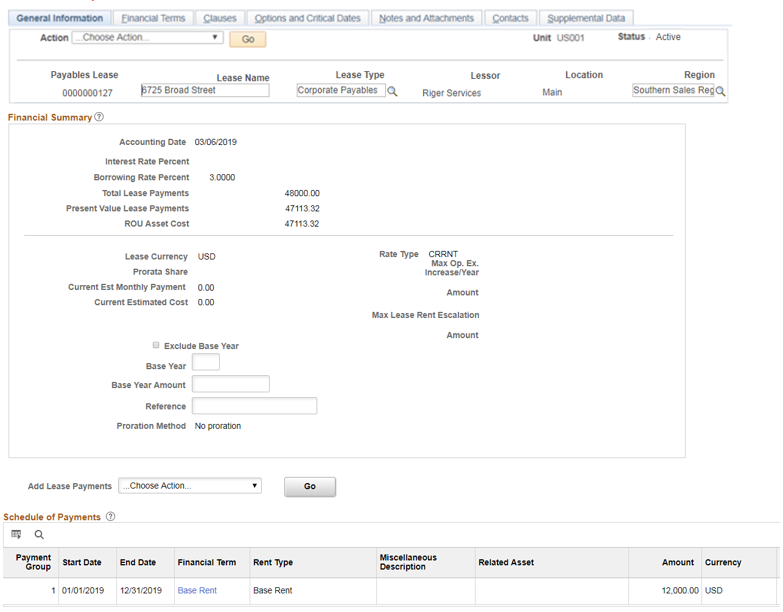

Here are screen shots from the General Information and Financial Terms:

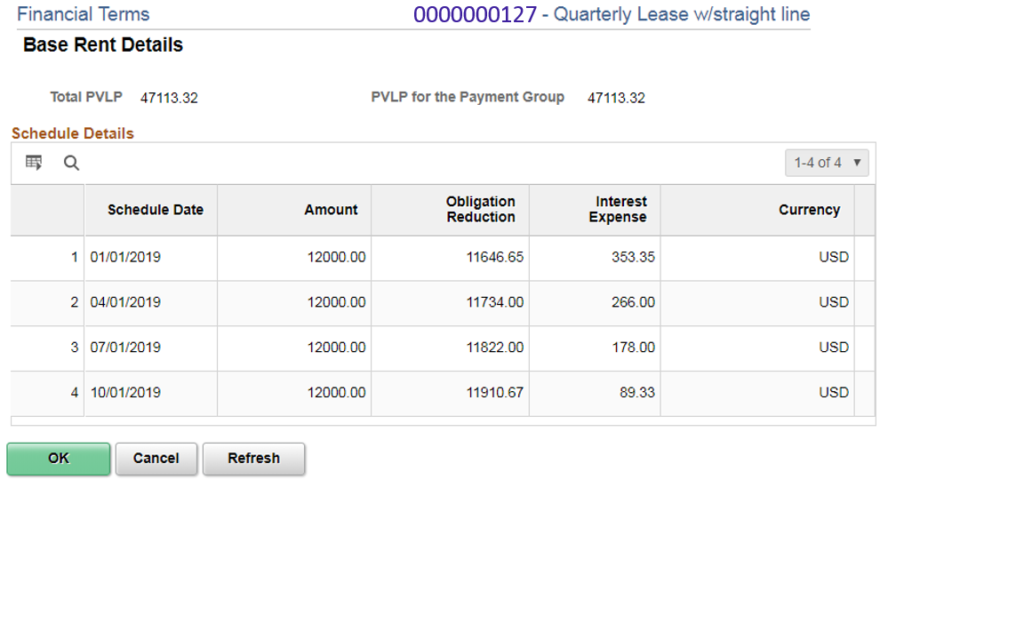

The Payment Schedule page including each of the four quarterly payments and the obligation reduction for each payment are shown below:

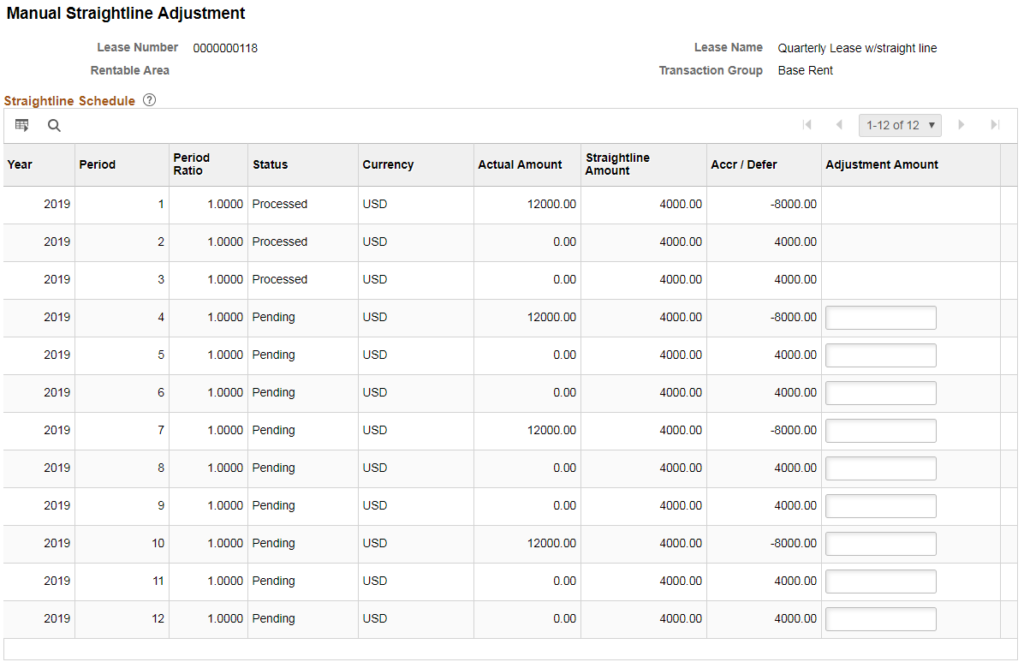

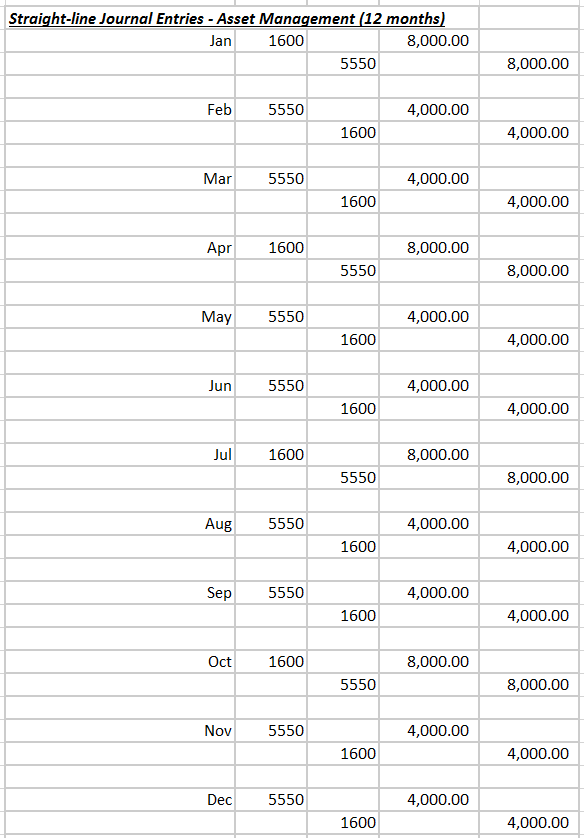

Next, we have the straight-line amounts which automatically adjust the straight-line expense across all 12 months of the lease. With 4 payments of $12,000, the total is $48,000 over the life of the lease. Then divide $48,000 by the length of the lease (12 months), and we have a straight-line expense of $4,000 per month. So for every quarter, we have 1 month with a $12,000 expense payment and 2 months without any payment. To average out our expenses over each quarter, the adjustments would be (8,000), 4,000 and 4,000 for each month respectively in that quarter (as shown below by PeopleSoft on the straight-line adjustment page). Remember, all the straight-line amounts were calculated automatically. I am just using the manual straight-line page below since it details the adjustments for each month.

Looking at the months of January, April, July & October, we have the $12,000 payment which will be expensed. For those months, we have a deferred amount of ($8,000) which will give us a net expense of $4,000. For all the other months that do not have a payment, we have an accrued amount of 4,000 (giving those months $4,000 of expense as well).

As I said, this page gives a very good snapshot of the straight-line amounts, and it is downloadable to Excel.

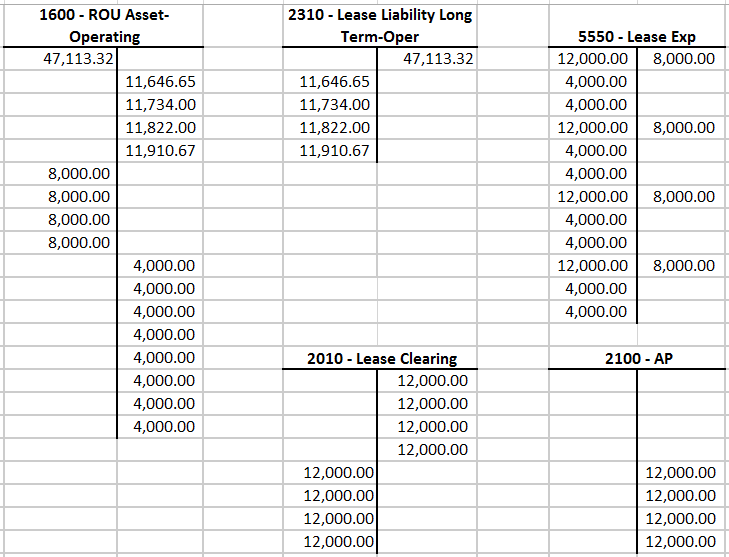

Now, let’s move on to the journal entries which can be viewed directly from the lease or from Asset Management via the Asset ID. For the purpose of this blog, I have consolidated the all journal entries from the entire life of the lease onto a spreadsheet. I have also grouped them by purpose. Again, remember all these journal entries are automatically created by PeopleSoft. No manual intervention is required.

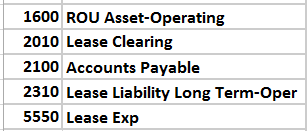

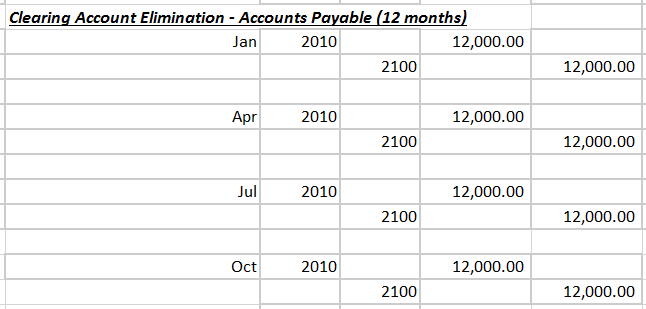

For reference, here are the accounts that we will use for this lease:

First, we have the add journal entries from Asset Management that were created when the lease was activated. The amounts here tie to the ROU/PVLP amounts.

Second, we have obligation & ROU reduction journal entries from Asset Management for each quarter. These amounts tie to the obligation reduction column from the payment schedule

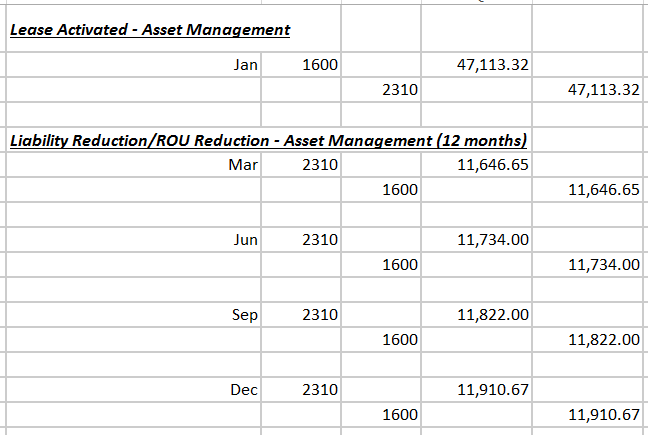

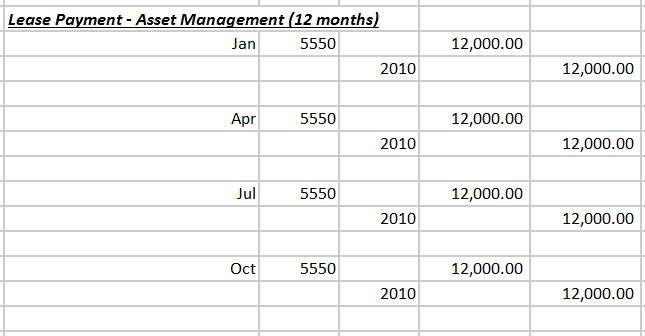

Here are the journal entries to record the lease payments and lease expense:

These are generated by Asset Management. The credit offset is to the Lease Clearing account which in turn is cleared out when the payment vouchers are created in Accounts Payable.

As mentioned above, when the payment vouchers are created in Accounts Payable, account 2010 is cleared out. The payment will be in Accounts Payable until it is paid. Again, all these journal entries are automated.

Next, we have our monthly straight-line journal entries from asset management.

These amounts tie to the straight-line schedule shown above and average the lease expense to $4,000 per month.

Lastly, I have consolidated all the journal entries into T-accounts to get a better visual on how the account balances work over time during the life of the lease. The only journal entries that I did not include were the payments which would have been a debit to Accounts Payable and a credit to Cash.

In closing, I find this lease an excellent example of Lease Administration functionality. The product’s ability to automate all these journal entries is why this is one of my favorite lease transactions. No manual intervention was required at all to create these entries. Also, the automated principles shown here apply equally to leases with built-in escalation clauses also requiring straight-line adjustments. In this blog, I discussed all the journal entries on an end-to-end basis for this lease so that you may verify the results on your own as well.

As always, thank you for reading and be sure to read my next installment in this series & our other Lease Administration Blogs.

Steven Brenner, CPA

Senior Principal Consultant

MIPRO Consulting