Hello again everyone. This is now part III of a five-part series that I have devoted to taking a deep dive on the new lease accounting standards. The next 2 blogs in the series, parts 3 & 4, will be an expanded discussion for our lease accounting example that was started in the previous blog. For your reference, here is the complete list of the 5-part series:

- Blog series introduction and New lease accounting terminology

- Basic lease accounting example

- Expanded lease accounting discussion – I

- Expanded lease accounting discussion – II

- Blog series wrap-up & next steps

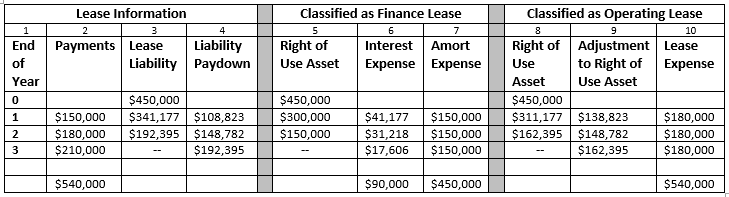

In our previous blog, we compared lease accounting balances between the current standards and the upcoming new accounting standards. In the next 2 blogs, I am going to take a more in-depth look at our lease to discuss the new accounting standards further. Per the title of my blog series, I only mention ASC 842 and I do not mention IFRS 16. With ASC 842 all leases will need to have a classification test applied and will be classified either as a finance lease or as an operating lease. Whereas with IFRS 16 all leases will be classified as a finance lease. Thus, going forward when discussing finance leases, this will apply to both ASC 842 and IFRS 16 and when discussing operating leases, this will apply to only ASC 842.

Here are the lease details from our previous blog, #2

Property Lease: 3 years

Yearly Payments: $150,000, $180,000, $210,000 = Total – $540,000

Borrowing interest rate: 9%

ROU Asset Value – $450,000

Lease Liability – $450,000

In this expanded discussion let’s look at the journal entries that would be created to support our above lease data and the resulting accounting balances. First let’s look at the journal entries for this lease using the current accounting standards:

With the current accounting standards, the journal entries are very straight forward. No journal entries are required at the start of the lease. The year-end journal entries reflect the cash payment amount and the amount needed to support straight-line accounting. Notice that total lease expense here equals $180,000.

Now, let’s move on to the journal entries need to support the new accounting standards, and for review, here are the accounting balances that we covered in the previous blog:

Looking at the journal entries above we can now compare the differences between classifying this lease as a finance lease or as an operating lease. In the finance lease, we amortize the capitalized ROU asset, whereas, in the operating lease we adjust the ROU asset. For the expense amounts, the finance lease uses a combination of amortization expense and interest expense. The operating lease expense amount is equal to the straight-line amount of $180,000 but now includes several components that make up that amount. Also for the operating lease, the ROU asset adjustment is a net amount derived to balance out the journal entry.

To wrap things up for this part of the blog series, the purpose was to take an expanded look at our lease and do a walk-through of the journal entries required to support the accounting balances that I detailed in part 2. This should help to identify the accounting data that need to be tracked.

In my next blog of the series, I am going to take another expanded look at our lease and cover a few more detailed examples on the new lease accounting standards.

Thank you for reading and be sure to read our other Lease Administration Blogs.

Steven Brenner, CPA

Senior Principal Consultant

MIPRO Consulting