Welcome back everyone to Part IV of my blog series, “Accounting Flexibility with PeopleSoft Lease Administration.”

In Part IV, we are looking at the accounting for leases with Initial Direct Costs and Lease Incentives. PeopleSoft Lease Administration defines amounts paid in addition to the monthly lease payments as Initial Direct Costs (IDC’s). Examples include leasehold improvements or fixed costs to prepare leased equipment. Whereas Lease Incentives are defined as any money received during the lease period. Examples includes things like incentive amount for lease buildouts or amounts received for signing an extended lease.

To start, let’s look at 3 different leases. First, I will present my control lease that has only monthly lease payments. Next, we will look at a lease with Initial Direct Costs and then a lease with Lease Incentives. For comparison purposes, the monthly payments will be the same for all 3 examples; just the IDC & Lease Incentive differ.

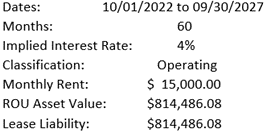

Lease #1: All monthly payments (control lease)

First, let’s look at the control lease that just has monthly payments.

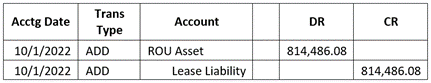

1. Upon activating the lease, Lease Administration would record the following accounting entry. A debit to the ROU Asset account and a credit to the Lease Liability account:

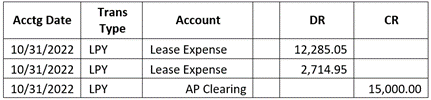

2. Then at the month-end close, Lease Administration will record the following 2 entries:

a. To record the lease payment and expense. Since this is an Operating Lease, the entire payment amount is expensed to the Lease Expense account with the offsetting credit to the AP Clearing account. The amounts are straight from the amortization schedule.

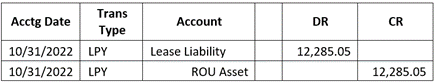

b. Then to record the ROU Asset and Lease Liability amortization, Lease Administration will record the second monthly entry.

Lease #2: Lease with Initial Direct Cost (IDC)

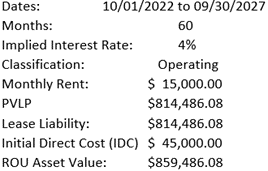

In this example the lease will still have all the same monthly payments as the control lease. In addition, this lease will include the IDC amount paid for $45,000 which increases the value of the ROU Asset but has no impact on the liability.

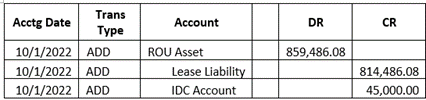

1. Upon activating the lease, Lease Administration would record the following accounting entry. A debit to the ROU Asset account for $859,486.08, which is the PVLP plus the IDC (814,486.08 + 45,000.00). The credit will be to the Lease Liability account for the PVLP and to the IDC Account to include the IDC costs in the lease.

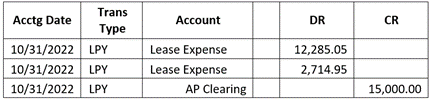

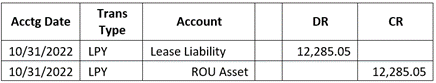

2. Then at the month-end close, Lease Administration will record the following 3 entries:

a. To record the lease payment and expense, the entire payment amount is expensed to the Lease Expense account with the offsetting credit to the AP Clearing account. The amounts are directly from the amortization schedule.

b. Then to record the ROU Asset and Lease Liability amortization, Lease Administration will record the second monthly entry.

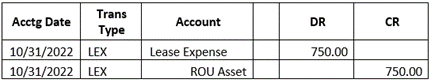

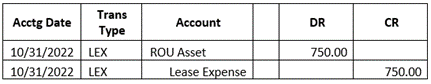

c. The last entry will be to record the straight-line expense for the Initial Direct Cost, IDC. This increases the monthly Lease Expense and the calculation here is to divide the IDC by the number of months: 750 = 45,000/60.

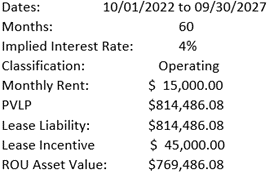

Lease #3: Lease with Incentive

In this example just as in the prior two examples, the lease will still have all the same monthly payments as the control lease. Then in addition, this lease will include the Lease Incentive amount received for $45,000 which decreases the value of the ROU Asset and, similar to the IDC, the incentive has no impact on the liability.

1. Upon activating the lease, Lease Administration would record the following accounting entry. A debit to the ROU Asset account for $769,486.08, which is the PVLP less the incentive (814,486.08 – 45,000.00). Then, the second debit will be to the Lease Incentive account to include the money received in the ROU calculation. The credit will be to the Lease Liability account for the PVLP.

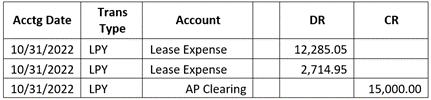

2. Then at the month end close, Lease Administration will record the following 3 entries:

a. To record the lease payment and expense, the entire payment amount is expensed to the Lease Expense account with the offsetting credit to the AP Clearing account. The amounts are directly from the amortization schedule.

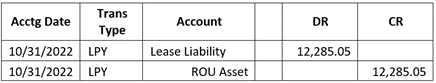

b. Then, to record the ROU Asset and Lease Liability amortization, Lease Administration will record the second monthly entry.

c. The last entry will be to record the straight-line expense for the Lease Incentive and the calculation here is to divide the incentive by the number of months: 750 = 45,000/60. Since the incentive is money received, the incentive will reduce the monthly lease expense, not increase it.

As you can see with each of the 3 examples, the monthly payments are all expensed the same way. Where the examples differ is that the IDC Lease has its rent expense increased each month by the straight-line amount. Conversely, the Incentive Lease has its rent expense decreased each month by the straight-line amount. Importantly for all 3 situations, Lease Administration has been designed to handle the accounting entries.

That concludes Part IV of “Accounting Flexibility with PeopleSoft Lease Administration”. In my next blog I will provide a walk-through on the accounting entries for Lease Impairment and Interest Rate Changes/Restructuring.

Finally, for additional information, checkout the whitepaper I authored, DEEP DIVE ASC 842 ACCOUNTING LEASE STANDARDS

Thank you for reading – Steven Brenner, CPA, Senior Principal Consultant