Welcome back everyone to Part III of my blog series, “Accounting Flexibility with PeopleSoft Lease Administration” series.

In the Parts I & II of this blog series, we discussed the flexibility of PeopleSoft Lease Administration with numerous different examples for leasing assets. Now with Part III of the series, we are going to take several of those lease examples and provide an accounting entry walk-through.

To start, let’s look at 3 different leases with pre-paid amounts and provide the accounting entries for the first month of each lease. Also, please note for comparison purposes, the ROU asset value is the same for all 3 examples.

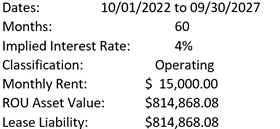

Lease #1: All monthly payments (no pre-payments)

First, let’s look at this lease with no pre-paid amounts for comparison purposes. Then next, we will look at 2 other variations of this lease that include pre-payments.

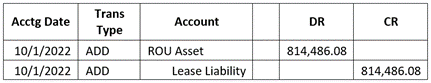

1. Upon creating the lease, Lease Administration would create the following accounting entry. A debit to the ROU Asset account and a credit to the Lease Liability account:

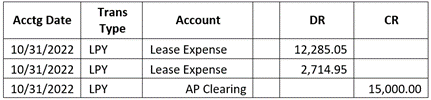

2. Then at the month-end close, Lease Administration will record the following 2 entries:

a. To record the lease payment and expense. Since this is an Operating Lease, the entire payment amount is expensed to the Lease Expense account with the offsetting credit to the AP Clearing account. The amounts are straight from the amortization schedule.

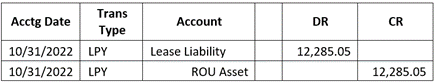

b. Then to record the ROU Asset and Lease Liability amortization, Lease Administration will record the second monthly entry.

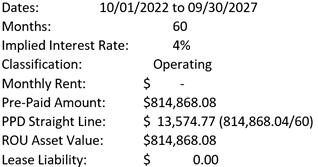

Lease #2: Entire lease pre-paid (no monthly payments)

In this example the lease will be paid with a single pre-paid amount at the beginning of the lease. Since there will not be any lease payments, this lease will not have any lease liability.

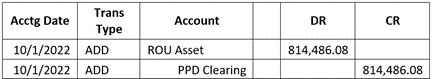

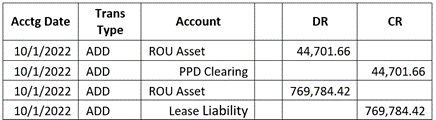

1. Upon creating the lease, Lease Administration would create the following accounting entry. A debit to the ROU Asset account and a credit to the Pre-Paid Clearing account, where optionally the pre-paid amount can be paid with Lease Administration or paid externally to Lease Administration.

2. Then at the month-end close, Lease Administration will record the following entry:

a. With the entire lease being pre-paid, Lease Administration only needs to record the Asset Amortization. No entry is needed to record payments or amortize a liability since there are no remaining payments. The monthly pre-paid amortization equals: $814,868.04/60 = $13,574.77.

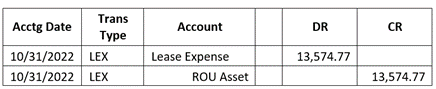

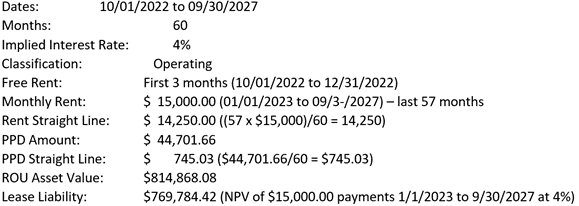

Lease #3: Monthly payments, 3 months free rent and a smaller pre-paid amount

For this lease, we are now going to include free rent in addition to a pre-paid amount to increase the overall complexity of the lease and demonstrate the additional accounting entries that Lease Administration needs to track.

1. Upon creating the lease, Lease Administration would create the following accounting entries. The first entry is to record the pre-paid amount with a debit to the ROU Asset account and a credit to the Pre-Paid Clearing account. The second entry is to record the NPV of the 57 lease payments with an additional debit to the ROU Asset account and with a credit to the Lease Liability account. Note in the is example, the opening ROU Asset balance and Lease Liability balance are not the same, with the difference being the pre-paid amount.

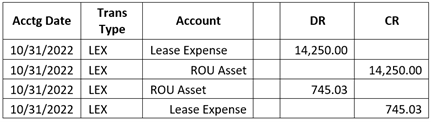

2. Then at the month-end close, Lease Administration will record the following 2 sets of entries:

a. The first set is to record the Lease Expense. Here we straight-line the payments over the life of the lease, 57 x $15,000)/60 = 14,250. Then we record the amortization of the pre-paid amount over the life of the lease, 44.701.66/60 = 745.03. This entry actually lowers Lease Expense as the free rent months are amortized over the remaining life of the lease.

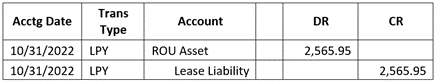

b. Then, the second set is to record the Interest Expense accrual against the free rent during each of the first 3 months. During the first 3 months, this accrual balance will increase the Lease Liability and the ROU Asset during the 3 free rent months. During the remaining 57 months, the accrual amounts will be amortized as rent is paid.

As you can see with each example, the monthly expense does differ with the inclusion for pre-paid rent and for the inclusion of free rent. Importantly for all 3 situations, Lease Administration has been designed to handle the accounting entries.

That concludes Part III of “Accounting Flexibility with PeopleSoft Lease Administration”. In my next blog, I will provide a walk-through on the accounting entries for Lease Incentives and Initial Direct Costs.

Finally, for additional information, checkout the whitepaper I authored, DEEP DIVE ASC 842 ACCOUNTING LEASE STANDARDS

Thank you for reading – Steven Brenner, CPA, Senior Principal Consultant