Deep Dive Blog Series: Part 2 of 5

Hello again everyone. This is now part II of a five-part series that I have devoted to the new lease accounting standards. This part will discuss a basic lease accounting example to compare the current standards to the new standards. For your reference, here is the complete list for the 5-part series:

- Blog series introduction and New lease accounting terminology

- Basic lease accounting example

- Expanded lease accounting discussion – I

- Expanded lease accounting discussion – II

- Blog series wrap-up & next steps

Let’s just jump straight in and do a walk-through on a basic lease accounting example to compare the current accounting standards to the new accounting standards.

Property Lease: 3 years

Yearly Payments: $150,000, $180,000, $210,000 = Total – $540,000

Borrowing interest rate: 9%

Current Lease Accounting Standards

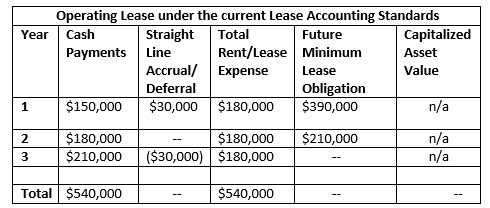

Using the current accounting standards for this lease using straight-line accounting would be $180,000 for each year. Under the current rules there would not be an asset on the balance sheet and the disclosure for future minimum lease obligations for years 1 & 2 would be $390,000 & $210,000 respectively.

Looking at the current accounting standards, the table below summarizes key accounting data. This includes disclosures for future minimum lease obligations. Notice that current lease accounting standards do not specifically require the value of the operating lease asset(s) be capitalized on the balance sheet.

Future Lease Accounting Standards with ASC 842

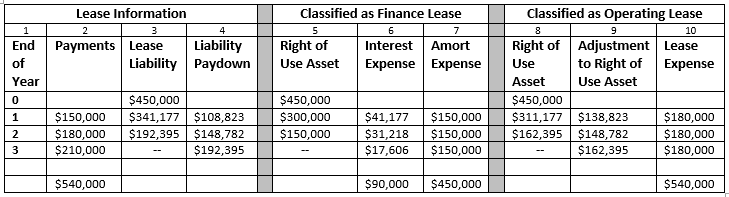

With the future accounting standards leases, there will be a test with five key criteria. Depending on the outcome of these tests, the lease will be classified as either a finance lease or as an operating lease. Just to confirm, later in the series I will cover the criteria tests in a bit more detail but for now let’s just focus on the accounting. I will then use the same lease payment information from above, including the borrowing interest rate to illustrate the key accounting data for this classified as both as either a finance lease and as an operating lease.

Looking at the table below in column 2, we still have the same lease payments as we used in the old accounting standards example above. Notice with the new standards a liability needs to be maintained on the balance sheet for both classifications, as shown in columns 3 & 4.

Finance Lease

If the lease is to be classified as a Finance Lease, the lease expense will be broken down into interest expense and amortization expense, columns 6 & 7. With the net balance of the asset on the balance sheet amortized each year as shown in columns 5 & 7.

Operating Lease

If the lease is to be classified as an operating lease, the lease expense will be a straight-line amount as shown in column 10. The adjusted balance of the asset on the balance sheet is shown in column 8 and Column 9 displays the adjustment amount which utilizes the borrowing interest rate as part of the adjustment.

As we can see with the old standard, disclosing the future minimum lease obligations is key and with the new standards, there will be rules for tracking the liability directly on the balance sheet. For tracking the lease expense and the asset balances, there will be different rules depending on how the lease is classified.

As part of my research on the new lease accounting standards I have read many publications on the topic, some of which were several hundred pages long. This blog is just meant to illustrate a very straight forward and simple example to highlight the new accounting balances that will be supported and tracked with PeopleSoft Lease Administration. Stay tuned for my next blogs where I will take an expanded look on the new lease accounting standards and discuss more in-depth lease examples.

Thank you for reading and be sure to read our other Lease Administration Blogs.

Steven Brenner, CPA

Senior Principal Consultant

MIPRO Consulting